Use the exercises in our free workbook to identify the right freelance rates for you.

The email you entered is invalid.

Thank you for subscribing.

By entering your email, you indicate that you have read and understood our Privacy Policy and agree to receive marketing from Squarespace.

Every interaction you have with your clients and customers is an opportunity to strengthen your relationship with them, including the process of getting paid. A smooth and clear payment process makes you look professional and leaves a positive impression on anyone who works with you.

On top of the basic details every invoice should have, like services provided and client information, there are also ways to improve the experience for your customers and simplify your workflow. Here are seven best practices and example invoices to get you started.

1. Keep the design clear

While your invoice should ideally be tailored to your business and brand, it’s important to prioritize getting key information across to your client. As you bring in brand fonts or colors, make sure it’s still easy to find and read important details like the payment deadline and pricing.

A simple way to brand your invoice while keeping your design clean is to add your logo to your invoices. You’ll pull in a bit of customization without sacrificing clarity.

Learn how to create your own logo

2. Make invoices detailed and accurate

Include everything your customers might need to know in your invoice to minimize confusion and limit the number of questions you need to answer when processing invoices. Your invoice should clearly state or link to specifics on:

Client’s name and contact information

Your business name and contact information

Invoice number

Date the invoice was issued

Services provided to the customer

Price, itemized for each service

Any taxes, additional fees, or discounts

Total amount due

Payment terms

Payment due date

Late or non-payment policies

Making it easy to find this information in your invoice sets clear expectations between you and your customers. And clear details and instructions will make it easier for you to get paid.

Get tips for setting rates for your services

3. Send invoices in a timely manner

It’s best to send invoices to your customers soon after you meet or deliver your services. That both allows you to get paid more quickly and puts the invoice on their to-do list while you’re still top-of-mind.

Make sure you also send your invoice well in advance of the payment due date. Depending on what’s typical for your industry, make sure clients have a reasonable window of time to get a payment to you. In some industries, a few days to one week is common, but 30 days is a typical turnaround time for other industries or corporate clients.

4. Make it easy to pay

Simple and familiar payment options give your clients flexibility and helps them feel confident that their payment information is secure. Connect your invoicing tool to a common payment processor, like Stripe, PayPal, or Square, or offer other digital payment options.

If you meet with clients in person, you can offer on-the-spot payment with a credit card reader or payments by secure mobile link. When your payment processor requires less information for someone to check out, it’s faster and easier for them to make an invoice payment.

5. Have clear payment policies

Clear and well-enforced policies set expectations for your clients and protect your time and cash flow as a small business owner. Your invoices should include details about:

How to pay

Accepted payment methods

Penalties for late or missed payments

Cancellation or no-show fees

Upcoming payments, if you charge a deposit or in installments

How get in touch with questions or concerns

Lean on your payment terms any time an issue arises. Having them written out should simplify any potential questions or issues with the invoicing process. But your terms are only as valuable as your enforcement of them.

Get more tips on running a service-based business

6. Automate your invoicing and receipts

A great scheduling tool can automate your invoicing process and save you time spent manually tracking and sending each payment. Squarespace allows you to send and track invoices, and can help you keep track of payment reminders and receipts.

If you also use Acuity Scheduling to manage your calendar, then you can automate your appointment management too. You can set your availability and allow clients to schedule, reschedule, or cancel their appointments with you themselves. Acuity automatically sends emails to confirm appointment bookings and changes and to remind clients about upcoming bookings.

You’ll be able to view and manage your invoices online in case you want to follow up on one personally, but your invoicing software can handle the rest.

7. Connect with your customers

The entire invoicing and payment process is a practice in customer service and support, but adding a personal touch can go a long way toward creating customer loyalty. This could be as simple as adding a small thank you note to each invoice. Or consider adding a discount code to invoices after a certain number of meetings.

Even if your invoices are automated, a note thanking clients and encouraging them to reach out with questions or leave a review for your business adds some warmth to an otherwise transactional communication.

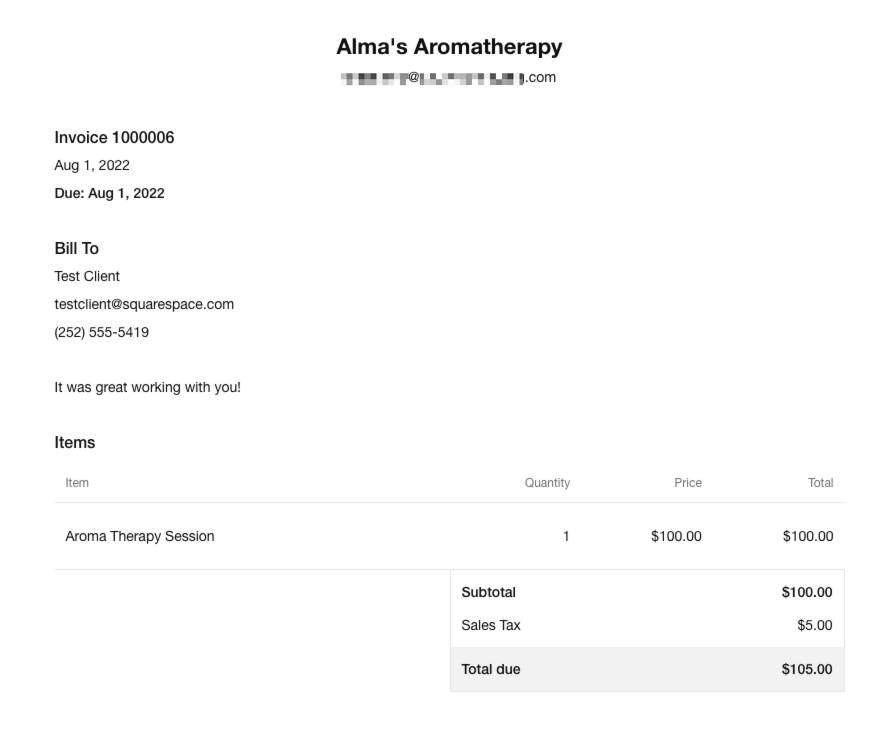

Client invoice example

If you use invoicing software, it will have templates to help you create a professional invoice that includes key client details. But it’s always helpful to have a reference point to see how other entrepreneurs handle their invoicing. Here’s one example you can reference and customize to suit your needs.

Note that these examples are for educational purposes only and should not be taken as legal or financial advice.

This invoice does a good job of showing:

Business name and contact details

Client contact information

Invoice number

Invoice date and due date

Itemized services and pricing, including sales tax

The business owner also includes a friendly personal note at the top of the invoice. With a digital invoice, you can include any additional information about payment methods and policies in the body of the email notification that goes to customers or link to the information on your website.